An oft-quoted line in the Simon and Garfunkel classic “The Sound of Silence” laments “people hearing without listening.” The same idea concludes Don McLean’s classic tribute to Vincent Van Gough, with the line “They would not listen, they’re not listening still – perhaps they never will.”

People not hearing, or not listening, is a frequent theme in pop culture, because it is such a frequent theme in real life. Lately it seems an especially apt description of politicians, even famously successful ones, who still fail to grasp the lessons of the 2016 election.

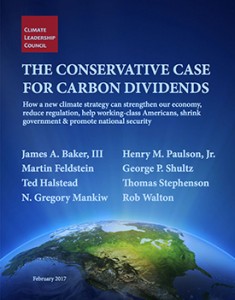

Several Republican “elder statesmen” recently published a new climate action plan, suggesting that the new Trump Administration adopt a gigantic carbon tax. It is eerily similar to the failed carbon tax proposed by the prior Administration, and still on the wish list of much of the global environmental industry.

The new proposal would fulfill the dreams of environmental leaders from Barack Obama and Al Gore to Daryl Hannah and Lisa Jackson. But it didn’t come from any of them; it was written and published by a group of wealthy, elite former Republican officeholders.

The new proposal would fulfill the dreams of environmental leaders from Barack Obama and Al Gore to Daryl Hannah and Lisa Jackson. But it didn’t come from any of them; it was written and published by a group of wealthy, elite former Republican officeholders.

James Baker and George Schultz served as Secretaries of State and Treasury under the last three Republican Presidents; Baker also served as Chief of Staff to both Reagan and Bush. Martin Feldstein and Gregory Mankiw both chaired the President’s Council of Economic Advisors under George W. Bush. Henry Paulson was the Goldman-Sachs executive and the latter Bush’s Treasury Secretary who helped bring about the 2008 economic collapse and binge of government bailouts. Together with Wal-Mart heir Rob Walton and a Silicon Valley venture capitalist who Bush appointed Ambassador to Portugal, these business-political tycoons have proposed a climate approach that is all too familiar.

Their plan begins with a tax of $40 a ton on carbon dioxide emissions, levied on oil, gas, and coal – and suggests that the tax increase in future years, ratcheting steadily upward until such fuels are no longer used. Nothing is new about that idea, a sure recipe for economic disaster (would these guys know a recession if they saw one?). However, they attempt to sweeten the deal with two “incentives” that would be new.

First, they propose that the money collected would be given directly to taxpayers, like the oil dividends in Alaska. In fact, the proposal itself is cleverly titled “The Conservative Case for Carbon Dividends.” But they can’t pay a dividend without first collecting a tax (not a conservative idea). And if the carbon tax generates $200-300 Billion annually in new revenue, as they estimate, I am not convinced Congress can be trusted to continue simply giving it back to the people as proposed, especially in times of unsustainable budget deficits.

Second, they propose to offset the impact on energy production by scaling back EPA regulations. They claim as carbon emissions decline, greenhouse regulations will simply become unnecessary. But unless they know a way to make China and India stop industrializing their economies, any carbon reductions in the U.S. alone would be almost unmeasurable – hardly an excuse for zealous federal regulators and their environmental allies to abandon the only system they understand. No, the global environmental industry will never agree that EPA regulations are no longer needed, no matter how much progress is made. Anyway, such a cynical political deal is not necessary. President Trump has already ordered an end to the coal-killing “Clean Power Plan,” even without the ill-advised tradeoff of a new tax.

Geophysicist Roger Andrews, who writes for Energy Matters, produced an excellent analysis of the economics of the proposed $40/ton carbon tax. Briefly, it would raise the price of oil about 25 percent, and the price of natural gas about double. But for coal, the price would triple in the Appalachians and increase six-fold or more in the Rockies. That would be a disaster in Colorado, where coal supplies over 60 percent of all electricity, and Wyoming where coal accounts for over 80 percent. Even the promised annual “dividend” of $2,000 (which would actually diminish as fossil fuels are phased out) would not offset the massive increase in gas prices, and especially electricity, paid by ordinary working people.

The Baker-Schultz-Paulson report is almost comical in its spin. “President Donald Trump’s electoral victory stems in large part from his ability to speak to the increasing frustration and economic insecurity that many voters feel the political establishment has failed to address. This frustration has found expression in a growing populist sentiment and yearning for fundamental change. A carbon dividends plan responds to these powerful trends.”

Apparently with a straight face, this comes from the very political establishment who failed so miserably to address that “frustration and economic insecurity.” And they now expect the public to be duped into supporting the very same government overreach. The only good news here is that their plan is dead on arrival in the new Administration, one whose election they can never understand as long as they continue “hearing without listening.” Perhaps they never will, but the rest of us should listen to the voters.

A version of this column originally appeared in the Grand Junction Daily Sentinel March 31, 2017.

Hi Greg, nice takedown of a cadre of political elitists that are leftists in conservative clothing. These swamp dwellers have kicked aside one the foundations of conservative ideals: less government is always better. Exactly what purpose would this proposal serve? Why not let market forces price these inputs? Why put a middleman (government) between citizens and the energy they consume?

As the trite, but relevant old saying goes….follow the money. I do not have proof but my gut tells me that this group of individuals would in some way profit if their proposal was implemented,

Keep fighting the good fight, Greg.

Best.

Glenn

Comments on this entry are closed.