The leadership of the House Ways and Means Committee just unveiled a new video touting what they call the “Tax Reform Blueprint,” a plan to simplify our taxes. The video is professionally produced, with nice music and a compelling message.

It begins by stating the problem we all understand. “America’s tax code is broken. It’s too complex and outdated, taking too much money away from hard-working taxpayers and sending it to wasteful Washington, favoring special interests, hurting American families, and forcing jobs and investment overseas. There is a better way – a way to bring that money home, to create new jobs and increase wages.”

That message is echoed by both sides in the current campaign, as in virtually all campaigns every year.

At the risk of betraying my age and longevity in politics, when I first went to work on Capitol Hill, Gerald Ford was President. I spent a semester as an intern in a House office, working for a congressman heavily involved in tax policy. One of the favorite issues among conservatives at the time was tax reform, especially tax simplification. Taxes were much higher in the pre-Reagan era, but the exorbitant rates were only part of the issue. The IRS was said to be too big and out of control, and the tax code much too complex. Sound familiar?

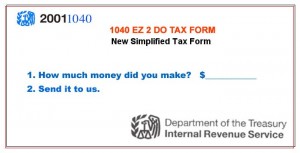

I remember several Members of Congress touting a reform package that included a tax form so simple it would fit on a postcard. In fact, there was a standing joke at the time about how the IRS might abuse the idea with a simple postcard form of two lines: “Line 1, How much money did you make; Line 2, Send it to us.”

Joking aside, though, the idea of a much simpler tax code has remained an appealing concept ever since. And sure enough, this new video promotes the new proposal from House leaders for “a pro-growth tax code with a tax form so simple it can fit on a postcard, with a modern tax system that brings businesses into the 21st Century, so we can compete and succeed anywhere in the world, especially here at home.”

Voters of both parties overwhelming support this idea, and always have. So what’s holding it up? Don’t get me wrong. I admit to a little cynicism because I have seen this movie before. But the proposal is sound, and the ideas behind it are solid. It includes full expensing, reductions in the corporate tax rates that are driving jobs overseas, and reductions in small business and personal tax rates. It reduces seven tax brackets to just three. It eliminates the alternative minimum tax so no one has to do their taxes twice a year, rewards work by improving the earned income tax credit, provides real tax incentives for charitable giving, stops overtaxing “Made in America” products, and repeals the death tax.

These are all issues with vast bipartisan public support, and Ways and Means Chairman Kevin Brady is right when he calls the proposal “bold” and “pro-growth.”

Staffers have put the new video on the Committee’s website and are making the rounds encouraging everyone to watch it, show it, and talk about it. They say we need to begin a public dialogue about the proposed policy changes and get this plan into the public discourse – especially during an election year in which tax policy is a crucial issue.

They are right, of course, that these issues are ripe for debate, and that the public ought to know about such proposals. So here is a modest idea. How about passing the bill?

The “Blueprint” was unveiled with some fanfare in June of this year on Capitol Hill, but it is difficult for congressional proposals to compete for news media attention during a national election campaign – especially one driven more by personalities than policies. Still, there is a clear and simple way to make sure such legislation attracts national attention, and that is to pass it. The same Party proposing the measure controls not only the Ways and Means Committee, but the entire House, and the Senate. They assume the President might veto it. Even if true, wouldn’t that create the national debate they want?

I was in a room full of people this morning watching the new video, and nearly everyone there – all allies of the proposal – had the same reaction. Namely, instead of making videos about the plan, why not enact it? Or will today’s congressional interns still be talking about the idea 40 years from now?

A version of this column originally appeared in the Grand Junction Daily Sentinel October 28, 2016.

Comments on this entry are closed.